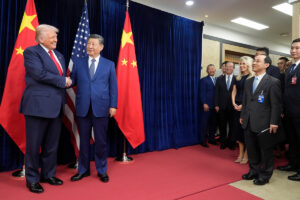

When U.S. President Donald Trump entered office a year ago under an “America First” banner, many expected China’s already-slowing economy to face mounting pressure. Instead, Beijing has responded by reshaping its trade strategy, warming relations with other partners, and recording unprecedented trade gains.

While Washington’s policies have strained relationships with long-standing allies, China has focused on strengthening economic ties elsewhere. Analysts say this shift has helped Beijing position itself as a more predictable trading partner for countries seeking stability amid growing uncertainty in U.S. policy.

Trade Surplus Hits Record Levels

China’s trade surplus reached a historic $1.2 trillion in 2025, supported by record monthly foreign-exchange inflows of around $100 billion and a broader global adoption of its currency, the yuan.

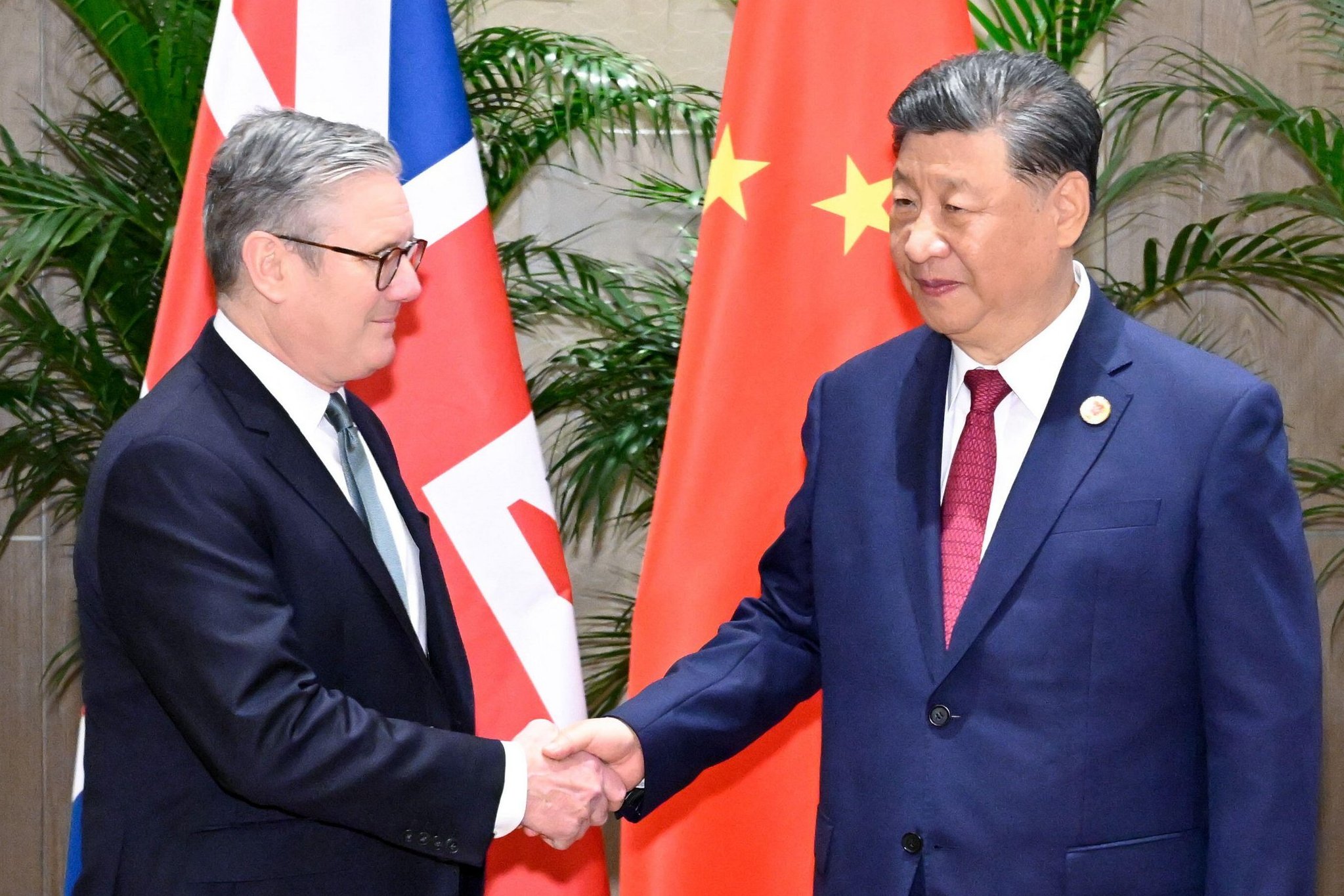

The renewed momentum comes as British Prime Minister Keir Starmer arrives in China this week, aiming to reset business ties that have cooled in recent years. Analysts expect the visit to further reinforce Beijing’s political and economic standing on the global stage.

With an economy valued at roughly $20 trillion and capital markets worth about $45 trillion, China is increasingly viewed by many countries as a steady alternative partner. Aleksandar Tomic, an economics professor at Boston College, said Beijing has successfully framed itself as reliable amid shifting global dynamics.

Derrick Irwin, co-head of intrinsic emerging markets equity at Allspring Global Investments, echoed that view, noting that China has emphasized predictability as U.S. trade policy has become more volatile.

Diplomatic Visits Signal Shift

Starmer’s four-day trip marks the first visit by a British prime minister to China since 2018. It follows a recent visit by Canadian Prime Minister Mark Carney, the first by a Canadian leader since 2017.

During Carney’s trip, Canada and China signed an agreement aimed at reducing trade barriers and building a new strategic relationship. Carney described China as a more consistent and dependable partner, highlighting a growing shift in global trade diplomacy.

China is not alone in seeking alternatives to U.S. trade dependence. Earlier this week, India and the European Union finalized a long-delayed trade agreement that will significantly cut tariffs and could double European exports to India by 2032.

China’s Economy Shows Resilience

Tensions between the world’s two largest economies intensified after Trump returned to the White House in January 2025, with disputes escalating across trade and technology sectors.

In April, the U.S. raised tariffs on Chinese goods to over 100%, later rolling back some measures under a temporary truce. In response, Beijing redirected exports toward non-U.S. markets and introduced policies to support private businesses and financial markets.

While Chinese exports to the U.S. fell by 20% in 2025, shipments rose sharply to other regions, including Africa (25.8%), Latin America (7.4%), Southeast Asia (13.4%), and the European Union (8.4%).

Despite deflationary pressures driven by weak domestic consumption and a prolonged property downturn, China still met its 5% growth target last year.

Yuan Gains Ground Globally

Beijing has also stepped up efforts to attract foreign investment, launching pilot programs in major cities such as Beijing and Shanghai to widen access to sectors including telecommunications, healthcare, and education.

China recorded its largest-ever monthly foreign-exchange inflow of $100.1 billion in December, pushing official reserves to a 10-year high of $3.36 trillion.

Financial markets have remained resilient, with the Shanghai index rising 27% over the past year, outperforming U.S. equities. At the same time, the yuan’s role in global trade has expanded as confidence in the U.S. dollar has been dented by Washington’s unpredictable policy stance.

Bankers say major international banks are increasing yuan liquidity in offshore hubs and accelerating settlement systems across Asia, the Middle East, and Europe. More than half of China’s cross-border transactions are now settled in yuan, compared with almost none 15 years ago.

Caution Remains Among Partners

Despite China’s growing outreach, some analysts urge caution. Patricia Kim, a foreign policy fellow at the Brookings Institution, said skepticism toward U.S. leadership does not automatically translate into trust in Beijing.

Many countries, she noted, continue to harbor concerns over China’s trade practices, economic leverage, and unresolved territorial disputes.

While China may currently appear more restrained compared with Washington’s confrontational approach, Kim warned that Beijing’s long-term behavior has yet to fully reassure many of its partners.