Investment by German companies in China climbed to its highest level in four years in 2025, highlighting how US trade policies are prompting businesses and governments to deepen economic ties elsewhere, according to data compiled for Reuters.

Previously unpublished figures from the IW German Economic Institute show that German firms invested more than 7 billion euros ($8 billion) in China between January and November last year. That represents a jump of about 55% compared with roughly 4.5 billion euros recorded in both 2023 and 2024.

US Trade Policy Drives Shift in Focus

The increase underscores how aggressive trade measures under President Donald Trump, including sweeping tariffs on European Union imports, have encouraged companies in Europe’s largest economy to look beyond the United States for growth.

Other governments are making similar moves. Britain is sending a business delegation to China this week to pursue deals across sectors from automotive to pharmaceuticals. The EU is edging closer to a trade pact with South America, while Canada is seeking to expand trade links with China and India.

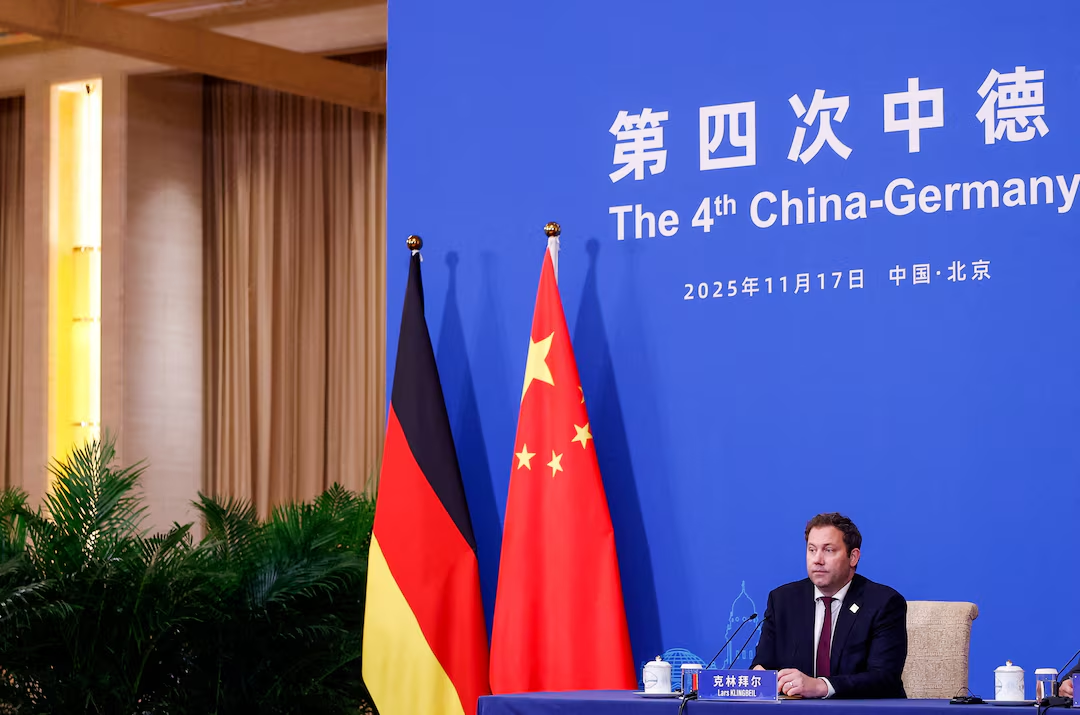

Berlin, meanwhile, has tried to strike a balance between taking a firmer stance on Beijing over trade and security issues while preserving ties with its most important trading partner.

Supply Chains and Risk Reduction

“German companies are continuing to expand their activities in China — and at an accelerated pace,” said Juergen Matthes, head of international economic policy at the IW institute. He pointed to a growing emphasis on strengthening local supply chains.

The trend comes as German firms scale back exposure elsewhere. Reuters reported last week that German investment in the United States nearly halved during the first year of Trump’s second term.

China also reclaimed its position as Germany’s top trading partner in 2025, after briefly being overtaken by the US a year earlier, driven largely by rising imports from the world’s second-largest economy.

Concerns Over Geopolitical Risks

Matthes said fears of escalating geopolitical tensions were also influencing corporate decisions, with companies seeking to ensure their China operations could function independently in the event of major trade disruptions.

“Many companies say that producing in China for the Chinese market reduces their exposure to tariffs and export restrictions,” he said.

Major German corporations — including BASF, Volkswagen, Infineon and Mercedes-Benz — remain heavily reliant on China, the world’s largest market for cars and chemicals.

Volkswagen said investments in China and the US were being pursued independently, reflecting local market strategies. The automaker added that technologies developed in China are increasingly being deployed across regions such as Southeast Asia, the Middle East, South America and Africa.

“China is helping to strengthen the group’s global competitiveness,” a company spokesperson said.

Broader Investment Trends

German Economy Minister Katherina Reiche this week highlighted the need to build new alliances as long-standing economic relationships become more fragile.

Industrial firm ebm-papst said it invested 30 million euros in expanding its China operations last year — more than a fifth of its total capital spending — to manufacture closer to its customers.

“This approach has proven to be a key source of stability, especially during periods of tariffs and geopolitical uncertainty,” the company said, adding that it also plans to expand its US operations this year.

According to the IW report, which draws on data from Germany’s Bundesbank, total German investment in China in 2025 also exceeded the long-term annual average of about 6 billion euros recorded between 2010 and 2024.